Welcome to Rio South Texas,

Welcome to Rio South Texas, where vibrant communities on both sides of the Rio Grande River come together to create unparalleled global opportunity and a richer, more rewarding setting for life and work.

No other single location can supply what Rio South Texas offers as one region: The best of the U.S. and the best of Mexico, allowing your enterprise to leverage an incomparable wealth of North American assets.

The Highest Operational Performance.

Put your enterprise at the heart of a stable, resilient supply chain at the geographic crossroads of North American trade routes extending towards both East and West Coasts. That means swift, easy access to 25% of the global consumer market in a temperate climate that facilitates nonstop year-round shipping.

The region’s youthful and diverse population is growing rapidly, backfilling the talent pipeline to assure robust workforce access long into the future. Eager for opportunity, our dynamic young workforce brings energy, passion, and agile skills to the workplace—a key competitive asset for your enterprise.

Create top North American quality at globally competitive prices thanks to the flexibility to maintain operations on either or both sides of the Rio Grande River. Rio South Texas allows your enterprise to implement business and manufacturing processes tailored to suit and succeed by leveraging cost advantages of the United States and Mexico in one region.

Leverage superb choices in sites—from greenfield to turnkey facilities—many with Foreign Trade Zone designations, ready to roll now. These sites commonly offer Interstate access; many also offer Class I rail access and are connected by road and rail to the region’s deep water sea ports. In addition, international airports and the Space X launch site at Starbase, TX provide access to customers all around the world, and beyond.

A powerful partnership. Compelling place advantages.

Established Global Trade

With foreign direct investment from across the globe, Rio South Texas is your established global trade portal and partner.Bi-National Structural Support

Realize enterprise goals with greater ease thanks to deeper, broader governmental and community cooperation and support. Here in Rio South Texas, economic development leaders at the national, state, county, and municipal level come together to help business prosper. We strive together and we thrive together.Sea Breeze & Palm Trees

Sunkissed and blessed with year-round warmth, Rio South Texas is an outdoor enthusiast’s paradise. Relax in the shade of palm trees in your back yard or play your way across the region—swimming, diving, sunbathing, or choose from fishing along 80 miles of Gulf of Mexico beaches or further inland, hiking, biking, birding, and world class hunting.Diverse and Welcoming Community

Rio South Texas’ richness of culture offers a life to savor. From music, to art, to international cuisine, life here feeds your soul. Thanks to our diverse influences we speak multiple languages here, but we speak with one voice in supporting your needs and welcoming you and your operation into our warm and inviting communities. We are family here; you are family, too.Here in Rio South Texas, we are one. Come flourish as one of us.

A powerful partnership. Compelling place advantages.

Established Global Trade

With foreign direct investment from across the globe, Rio South Texas is your established global trade portal and partner.

Bi-National Structural Support

Realize enterprise goals with greater ease thanks to deeper, broader governmental and community cooperation and support. Here in Rio South Texas, economic development leaders at the national, state, county, and municipal level come together to help business prosper. We strive together and we thrive together.

Sea Breeze & Palm Trees

Sunkissed and blessed with year-round warmth, Rio South Texas is an outdoor enthusiast’s paradise. Relax in the shade of palm trees in your back yard or play your way across the region—swimming, diving, sunbathing, or choose from fishing along 80 miles of Gulf of Mexico beaches or further inland, hiking, biking, birding, and world class hunting.

Diverse and Welcoming Community

Rio South Texas’ richness of culture offers a life to savor. From music, to art, to international cuisine, life here feeds your soul. Thanks to our diverse influences we speak multiple languages here, but we speak with one voice in supporting your needs and welcoming you and your operation into our warm and inviting communities. We are family here; you are family, too.

Here in Rio South Texas, we are one. Come flourish as one of us.

Our Sponsors

Top Industries

Automotive

Aerospace

Biomedical

Energy

Top Industries

Automotive

Aerospace

Biomedical

Energy

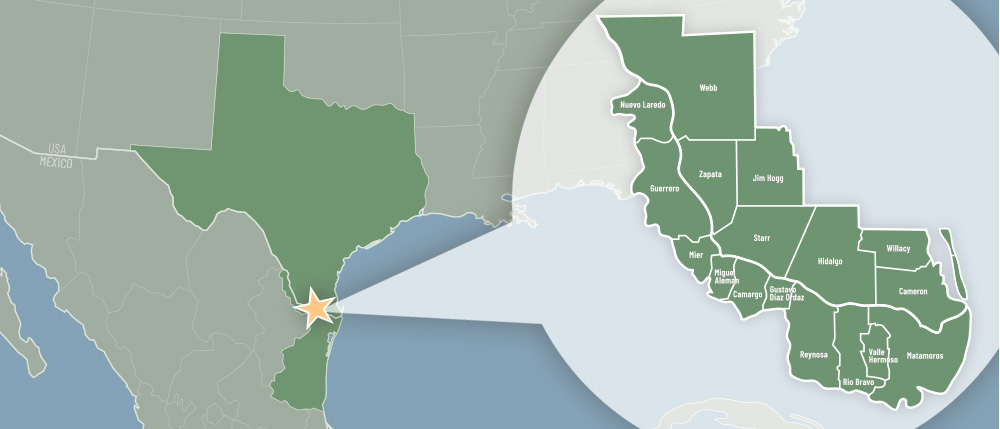

Location Map

Population

1.7 MILLION

On U.S. Side

Population

3.5 MILLION

On Mexico Side

Texas

9th

Largest Economy In The World

Easy Access To

25%

Of The Global Consumer Market

Population

1.5 MILLION

On U.S. Side

Population

3.5 MILLION

On Mexico Side

Texas

9th

Largest Economy In The World

Easy Access To

25%

Of The Global Consumer Market

COSTEP: Building On A Strong Foundation

By bringing together the private and public sectors, The Council for South Texas Economic Progress (COSTEP) is forging new pathways for regional prosperity through a variety of economic development initiatives. These initiatives work in concert with COSTEP’s historic educational mission, helping families flourish through efforts that include helping fund millions of dollars in scholarships and providing free financial literacy education programs. Throughout the organization’s 49-year history, COSTEP’s one goal has been to help local residents provide a better life for themselves and their families.